The Best Strategy To Use For Pkf Advisory Services

The Best Strategy To Use For Pkf Advisory Services

Blog Article

The 6-Minute Rule for Pkf Advisory Services

Table of Contents6 Easy Facts About Pkf Advisory Services ShownThe 25-Second Trick For Pkf Advisory ServicesWhat Does Pkf Advisory Services Do?The Definitive Guide for Pkf Advisory ServicesPkf Advisory Services Things To Know Before You Get This

Recognizing that you have a strong monetary strategy in position and professional advice to transform to can reduce anxiousness and enhance the quality of life for lots of. Broadening access to monetary suggestions might likewise play a vital duty in lowering riches inequality at a societal level. Often, those with lower revenues would certainly profit the most from financial advice, but they are additionally the least most likely to afford it or know where to seek it out.Conventional financial advice versions generally offered wealthier people in person. Designs of economic suggestions are currently usually hybrid, and some are even digital-first.

Pkf Advisory Services - An Overview

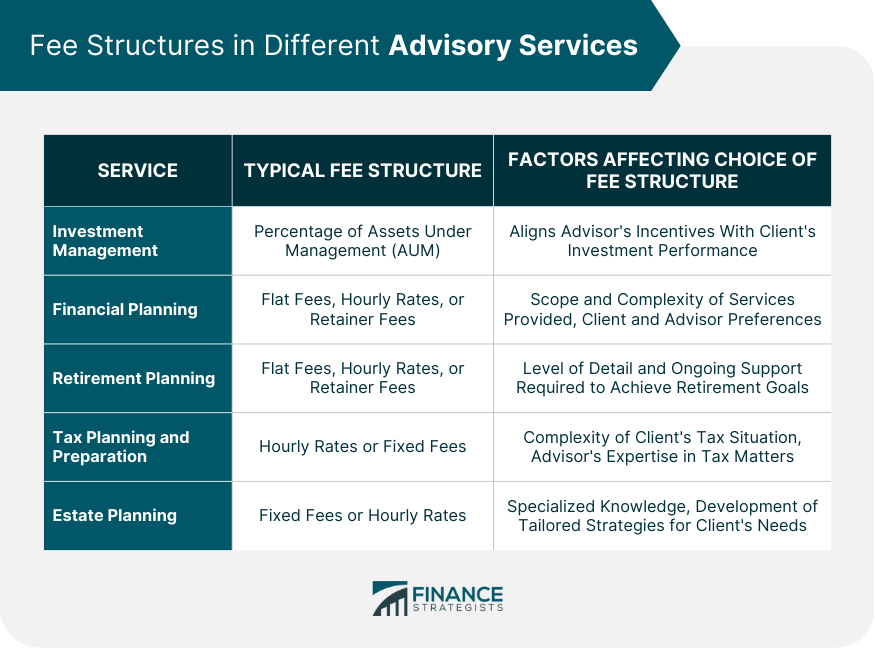

There is currently an evolving breadth of suggestions models with a variety of pricing frameworks to suit a gradient of client requirements. An additional significant obstacle is a lack of trust in economic advisors and the recommendations they provide. For instance, in Europe, 62% of the adult population is not confident that the financial investment recommendations they get from their bank, insurer, or economic advisor is in their best rate of interest.

The future explained right here is one where financial well-being is accessible for all. It is a future where monetary suggestions is not a deluxe but a vital solution easily accessible to everyone. The benefits of such a future are far-reaching, but we have a long way to visit reach this vision.

Along with the usually difficult psychological ups and downs of separation, both partners will certainly have to deal with crucial financial considerations. You might very well need to alter your monetary approach to maintain your goals on track, Lawrence states (PKF Advisory Services).

An unexpected influx of money or possessions elevates instant questions concerning what to do with it. "A monetary expert can help you analyze the methods you could put that money to function towards your individual and monetary goals," Lawrence claims. You'll wish to think of how much might most likely to paying for existing debt and how much you may take into consideration spending to seek an extra secure future.

All About Pkf Advisory Services

No two people will certainly have fairly the very same collection of investment strategies or solutions. Depending upon your goals as well as your resistance for risk and the time you need to seek those goals, your advisor can aid you recognize a mix of financial investments that are appropriate for you and developed to aid you reach them.

Throughout these conversations, voids in existing strategies can be determined. A critical benefit of producing a plan is having an extensive sight of your economic circumstance. When you can see the whole photo, it's less complicated to see what's missing. When life changes and you hit a bump on your economic roadmap, it's simple to leave track.

The 20-Second Trick For Pkf Advisory Services

Will I have sufficient saved for retired life? An extensive, written plan offers you a clear image and instructions for methods to reach your goals.

It is for that reason not unusual that amongst the participants in our 2023 T. Rowe Price Retirement Savings and Investing Study, 64% of baby boomers reported moderate to high levels of stress and anxiety concerning their retired life cost savings. When planning for retired life, individuals might take advantage of educational sources and electronic experiences to assist them compose a formal strategy that details anticipated expenses, income, and possession administration approaches.

Creating a formal written prepare for retired life has revealed some vital advantages for preretirees, consisting of enhancing their confidence and exhilaration concerning retired life. The majority of our preretiree survey respondents were either in the procedure of developing a retirement or believing regarding it. For preretirees who were within five years of retired life and for senior citizens in the read this article five years after their retired life date, information showed a meaningful rise in formal retirement preparation, consisting of seeking assistance from a monetary expert (Fig.

Pkf Advisory Services - Truths

Preretirees might discover value in an array of services that will aid them prepare for retired life. These can consist of specialized education to aid with the withdrawal and revenue phase or with vital decisions such web link as when to collect Social Safety and security.

Report this page